Advertisement

-

Published Date

May 16, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

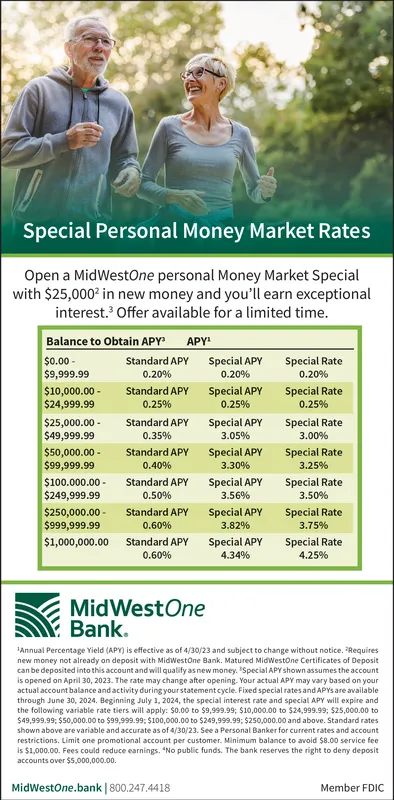

Special Personal Money Market Rates Open a MidWestOne personal Money Market Special with $25,000² in new money and you'll earn exceptional interest.³ Offer available for a limited time. Balance to Obtain APY³ APY¹ Standard APY 0.20% $0.00- $9,999.99 $10,000.00 - $24,999.99 $25,000.00 - $49,999.99 $50,000.00 - $99,999.99 $100.000.00- $249,999.99 Standard APY 0.25% Standard APY 0.35% Standard APY 0.40% Standard APY 0.50% $250,000.00 - $999,999.99 $1,000,000.00 Standard APY 0.60% Standard APY 0.60% Special APY 0.20% Special APY 0.25% Special APY 3.05% Special APY 3.30% Special APY 3.56% Special APY 3.82% Special APY 4.34% Special Rate 0.20% Special Rate 0.25% Special Rate 3.00% Special Rate 3.25% Special Rate 3.50% Special Rate 3.75% Special Rate 4.25% MidWestOne Bank. ¹Annual Percentage Yield (APY) is effective as of 4/30/23 and subject to change without notice. Requires new money not already on deposit with MidWestOne Bank. Matured MidWestone Certificates of Deposit can be deposited into this account and will qualify as new money. Special APY shown assumes the account is opened on April 30, 2023. The rate may change after opening. Your actual APY may vary based on your actual account balance and activity during your statement cycle. Fixed special rates and APYs are available through June 30, 2024. Beginning July 1, 2024, the special interest rate and special APY will expire and the following variable rate tiers will apply: $0.00 to $9,999.99; $10,000.00 to $24,999.99; $25,000.00 to $49,999.99; $50,000.00 to $99,999.99; $100,000.00 to $249,999.99; $250,000.00 and above. Standard rates shown above are variable and accurate as of 4/30/23. See a Personal Banker for current rates and account restrictions. Limit one promotional account per customer. Minimum balance to avoid $8.00 service fee is $1,000.00. Fees could reduce earnings. "No public funds. The bank reserves the right to deny deposit accounts over $5,000,000.00. MidWestOne.bank | 800.247.4418 Member FDIC Special Personal Money Market Rates Open a MidWestOne personal Money Market Special with $ 25,000² in new money and you'll earn exceptional interest.³ Offer available for a limited time . Balance to Obtain APY³ APY¹ Standard APY 0.20 % $ 0.00 $ 9,999.99 $ 10,000.00 - $ 24,999.99 $ 25,000.00 - $ 49,999.99 $ 50,000.00 - $ 99,999.99 $ 100.000.00 $ 249,999.99 Standard APY 0.25 % Standard APY 0.35 % Standard APY 0.40 % Standard APY 0.50 % $ 250,000.00 - $ 999,999.99 $ 1,000,000.00 Standard APY 0.60 % Standard APY 0.60 % Special APY 0.20 % Special APY 0.25 % Special APY 3.05 % Special APY 3.30 % Special APY 3.56 % Special APY 3.82 % Special APY 4.34 % Special Rate 0.20 % Special Rate 0.25 % Special Rate 3.00 % Special Rate 3.25 % Special Rate 3.50 % Special Rate 3.75 % Special Rate 4.25 % MidWestOne Bank . ¹Annual Percentage Yield ( APY ) is effective as of 4/30/23 and subject to change without notice . Requires new money not already on deposit with MidWestOne Bank . Matured MidWestone Certificates of Deposit can be deposited into this account and will qualify as new money . Special APY shown assumes the account is opened on April 30 , 2023. The rate may change after opening . Your actual APY may vary based on your actual account balance and activity during your statement cycle . Fixed special rates and APYs are available through June 30 , 2024. Beginning July 1 , 2024 , the special interest rate and special APY will expire and the following variable rate tiers will apply : $ 0.00 to $ 9,999.99 ; $ 10,000.00 to $ 24,999.99 ; $ 25,000.00 to $ 49,999.99 ; $ 50,000.00 to $ 99,999.99 ; $ 100,000.00 to $ 249,999.99 ; $ 250,000.00 and above . Standard rates shown above are variable and accurate as of 4/30/23 . See a Personal Banker for current rates and account restrictions . Limit one promotional account per customer . Minimum balance to avoid $ 8.00 service fee is $ 1,000.00 . Fees could reduce earnings . " No public funds . The bank reserves the right to deny deposit accounts over $ 5,000,000.00 . MidWestOne.bank | 800.247.4418 Member FDIC